Timber Export Statistics

Timber Export Statistics

Sustainable Growth in Timber Exports

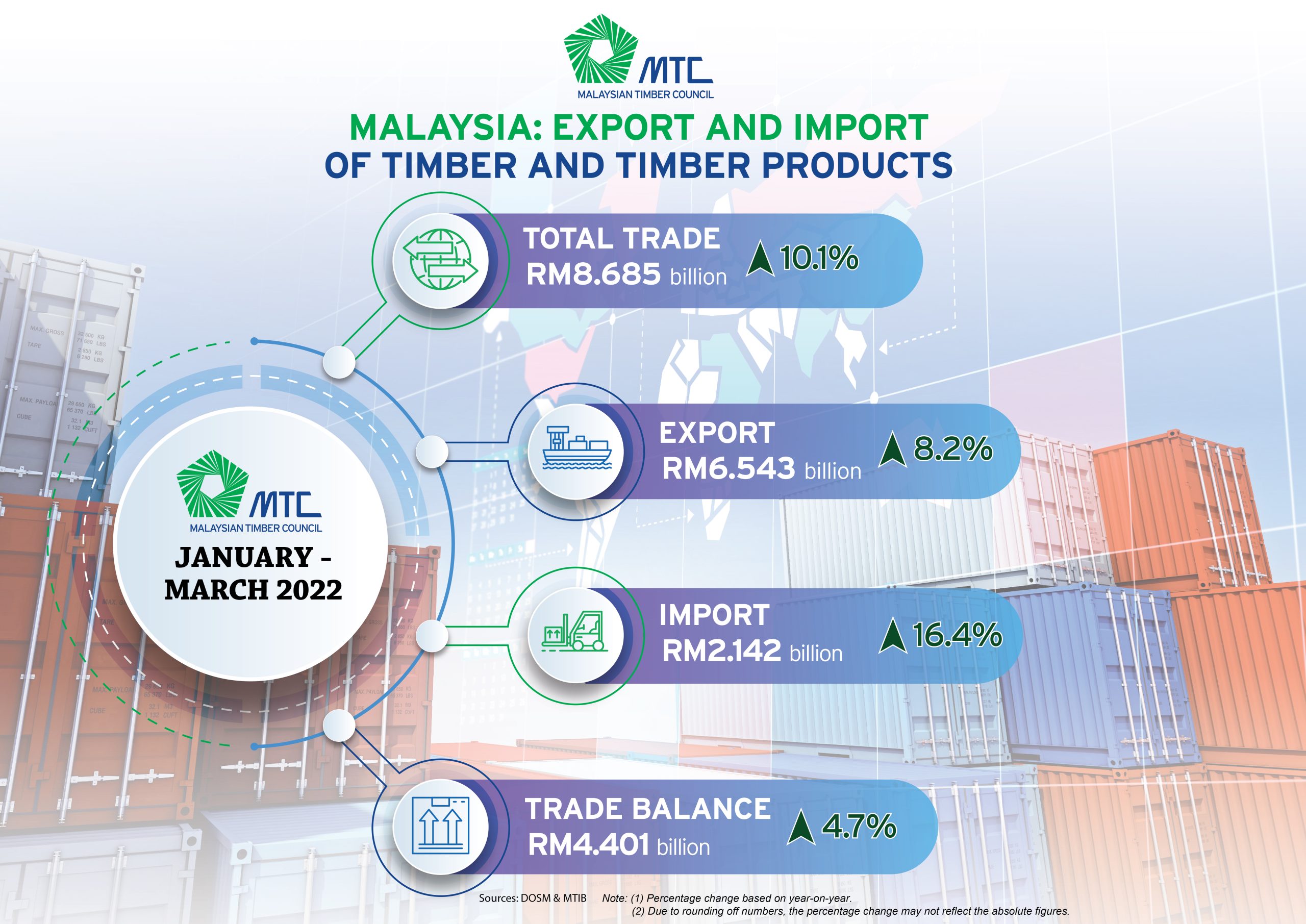

Explore the latest timber export statistics, sourced from DOSM and MTIB, to gain valuable insights into the industry’s growth, trends, and sustainable development. Stay informed and ahead in the ever-evolving timber market.